INDIA'S REAL ESTATE

India's REIT-Ready Office Market Poised for Significant Growth: A Real Estate Expert's View

February, 2024

The Indian real estate market, particularly in the office segment, has been experiencing remarkable growth, and a recent report by ICRA has shed light on the burgeoning potential of the REIT-ready office market. This report underscores the substantial size and promising future of this sector, offering a comprehensive view for investors, developers, and real estate professionals.

India's REIT-ready office

Understanding REITs and REIT-Ready Office Spaces

Real Estate Investment Trusts, or REITs, serve as investment vehicles that own and manage income-generating real estate assets. ICRA defines REIT-ready office spaces as Grade A office buildings with specific characteristics making them suitable for inclusion in a REIT portfolio. These characteristics typically include a minimum size requirement, strong occupancy rates, and prime locations in business districts.

- Minimum size: The building should have a certain minimum area, often exceeding 1 million square feet.

- Strong occupancy: The building should have a high occupancy rate, demonstrating consistent rental income.

- Location: The building should be situated in a prime business district with good connectivity and infrastructure.

India's REIT-ready office

A Market with Immense Potential

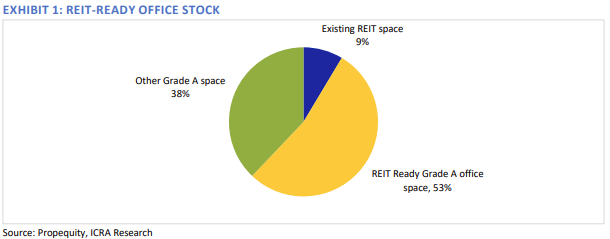

ICRA's estimation of the REIT-ready office supply across India's top seven cities at Rs. 5.8-6.2 lakh crore signifies a substantial portion of the total Grade A office space. Cities like Bengaluru, Mumbai Metropolitan Region (MMR), and Hyderabad lead in terms of supply, reflecting the geographical diversity and growth potential in the sector.

India's REIT-ready office erty dynamics in India

erty dynamics in India

Key Takeaways and Expert Insights

The report offers several key takeaways and expert insights, emphasizing the growth potential of the REIT-ready office market:

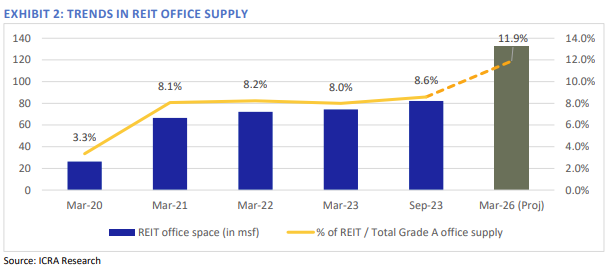

Growth potential: The report suggests that the REIT-ready office market has the potential to increase the size of the office REIT market by 6.0-6.5 times. This indicates significant growth opportunities for investors and developers in this segment.

Increased supply: The REIT office supply has grown by 3.3 times in the past five years, reflecting the rising demand for high-quality office space.

Healthy occupancy: Existing office REITs boast a healthy occupancy rate of around 84%, indicating strong rental income potential.

SEZs and future outlook: While occupancy has faced challenges due to vacancies in SEZ spaces, the recent government decision to allow partial denotification is expected to improve absorption and revive the attractiveness of SEZs in the medium term.

Long-term drivers: Favorable demographics, a skilled workforce, and competitive rental rates are expected to continue driving demand for Indian office space in the long run.

India's REIT-ready office

India real estate trend s, Booming real estate market, Shifting trends in property, Indian real estate revolution, Navigating property dynamics in India

s, Booming real estate market, Shifting trends in property, Indian real estate revolution, Navigating property dynamics in India

India's REIT-ready office

Overall, the report paints a positive picture for the Indian REIT-ready office market. With its substantial size, promising growth potential, and healthy fundamentals, this segment presents attractive opportunities for various stakeholders in the real estate landscape.

India's REIT-ready office

Additional Considerations for Stakeholders

In addition to the primary insights, the report highlights crucial points for stakeholders:

Diversification: The importance of diversification within the REIT portfolio is stressed to mitigate risks associated with specific sectors or locations.

Regulatory Impact: The influence of regulatory developments and government policies on shaping the future of the REIT market is acknowledged.

Sustainability Focus: Considerations for sustainability are emphasized, noting that investors and developers can enhance the long-term value of REIT-ready office spaces by incorporating green building practices.

India's REIT-ready office

In conclusion, the ICRA report paints an optimistic picture for the Indian REIT-ready office market. With its substantial size, promising growth potential, and robust fundamentals, this segment presents attractive opportunities for various stakeholders in the real estate landscape. By understanding market trends, considering diversification strategies, staying informed about regulatory changes, and incorporating sustainability practices, real estate professionals can position themselves to capitalize on the exciting opportunities presented by the growing Indian REIT-ready office market.

India's REIT-ready office

Follow Woodkraft on LinkedIn for the latest updates and inspiring workspace solutions.